Supply Chain Impacts to Beauty Gifting

Investigates consumer concerns and behaviors related to supply chain issues ahead of Holiday shopping with a focus on Beauty.

Table of Contents:

Methodology

Key Takeaways

Introduction

Supply Chain Disruptions

Uncertainty over Shortages and Gift Availability

Reliance on Gift Cards

Stockpiling and Inelastic Demand

Shopping Alternative Channels

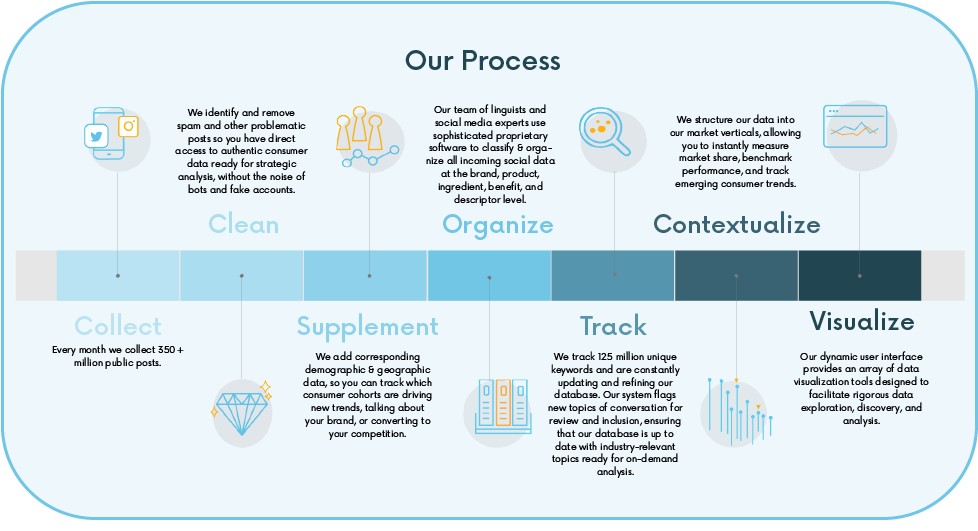

Methodology

To provide our clients with the latest insights, our proprietary platform collects, analyzes, and benchmarks social data. Here’s what that process looks like:

|

for more on methodology Click Here

Key Takeaways

Gifting Despite Shortages: Consumers may be hyper aware of gift availability this Holiday season such that they are changing the way they shop. They may be gifting promises of experiences rather than tangible products to avoid dealing with out of stocks or delays in shipping.

Prioritized Spending: In preparation for Holiday socializing, consumers may be prioritizing on-premise self care for themselves and others. Some may be planning to purchase more skincare products than they need in order to avoid having to go without for a period of time.

Relying on Ecommerce: Most consumers will be wary of shipping challenges and timelines such that companies that guarantee hassle-free and timely delivery could be positioned to outcompete those that do not.

Introduction

Consumers appear to be starting their Holiday shopping earlier than usual this year. While some may simply be excited to return to traditional celebrations following a scaled down and restricted "COVID Christmas," some may be intentionally safeguarding against manufacturer-related supply chain issues. Supply chain disruptions, resulting from COVID-19 shutdowns, are causing numerous challenges for shipping and inventory such that both businesses and consumers alike may be worried they will not get their shopping lists checked off before the Holidays.

As consumers react to the climate around them, companies will need to be vigilant of the impact these behavior changes have during one of the busiest commercial periods of the year. Furthermore, it will be important to understand which reactions will have down stream, longer term impacts outside of the Holiday shopping season. The following report examines public consumer conversations about Beauty on Instagram to investigate perceptions of supply chain issues and how these may me influencing consumers to shop differently.

Supply Chain Disruptions

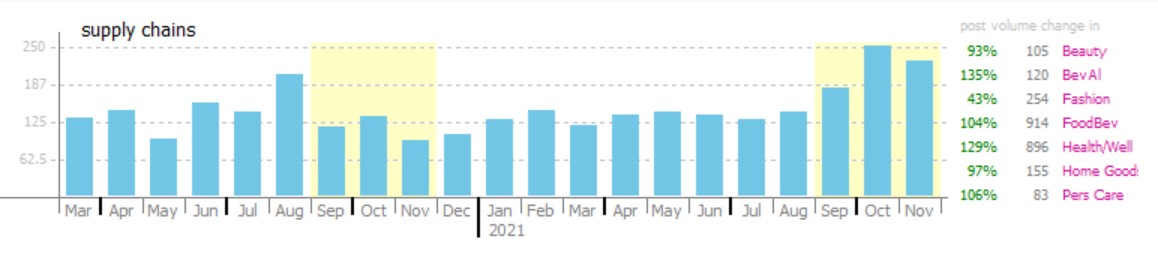

Instagram conversants are increasingly aware of COVID-related supply chain issues this Holiday season, as mentions of supply chain are growing YOY across every Social Standards vertical. Although the majority of conversations and growth appear to be in Food & Beverage and Health & Wellness contexts, mentions of supply chain in Beauty are growing at a rate of about 93%.

| Supply Chain Mentions in Beauty |

|

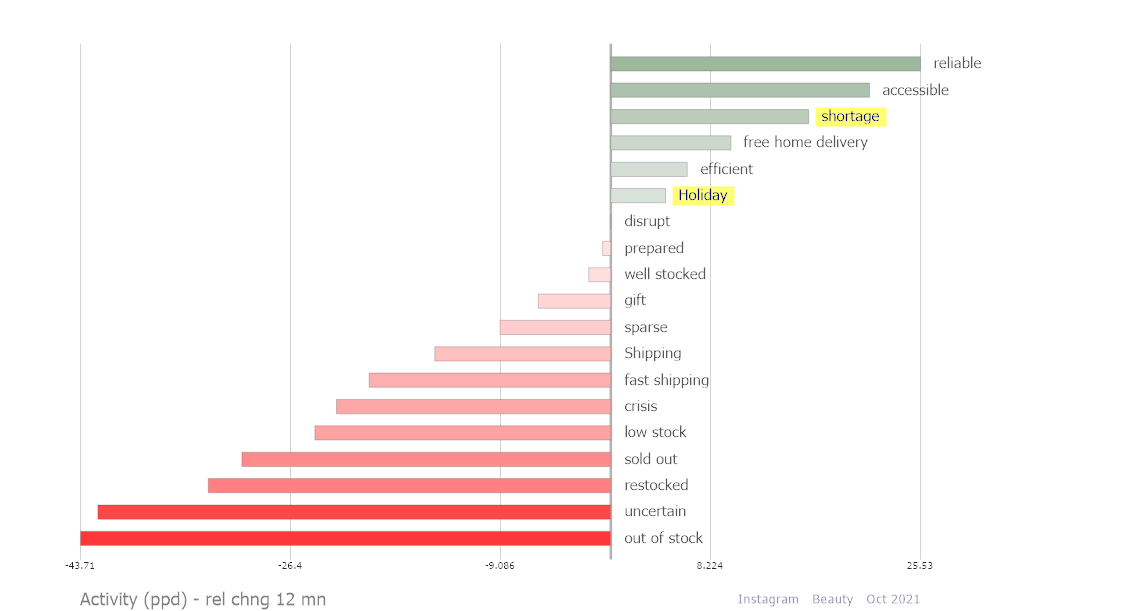

Some of the concern around supply chain in Beauty are driven by uncertainty and preparation for the Holidays, as well as shipping concerns and gift availability at retail. From among these concerns, mentions of shortage appear to be growing quickly, so consumers may be increasingly concerned with how supply chain shortages will impact their ability to shop.

| Select Holiday and Supply Chain Topics' Conversation Performance |

|

| X-axis: | Activity (ppd) chng | Is the topic growing or declining in Beauty over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Shading Color: | Activity (ppd) chng | Is the topic growing or declining in Beauty over the last 12 months (rel chng) - avg. over 3 months? |

Uncertainty over Shortages and Gift Availability

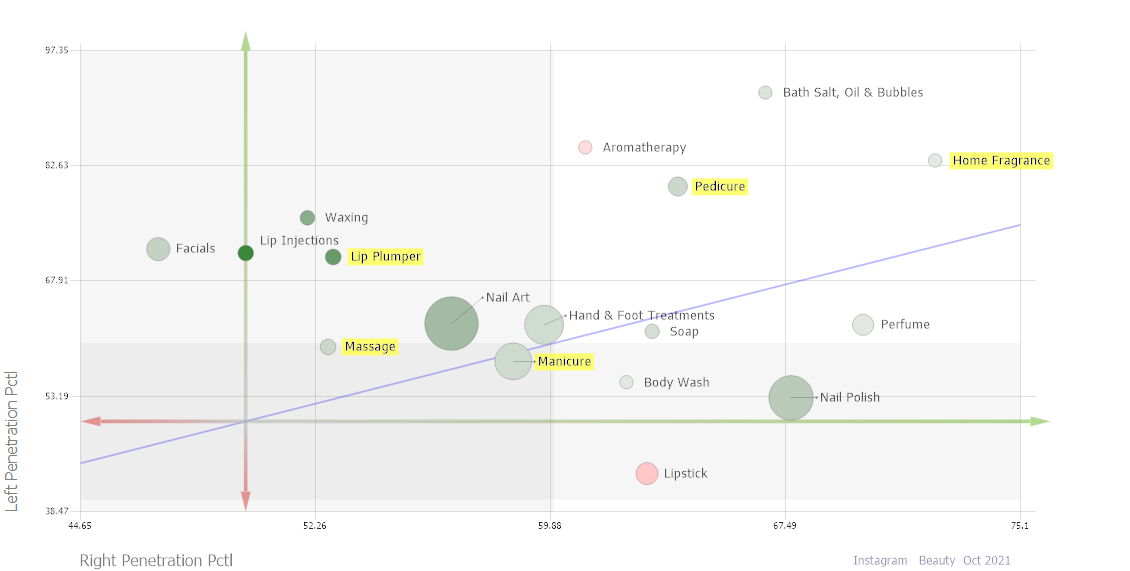

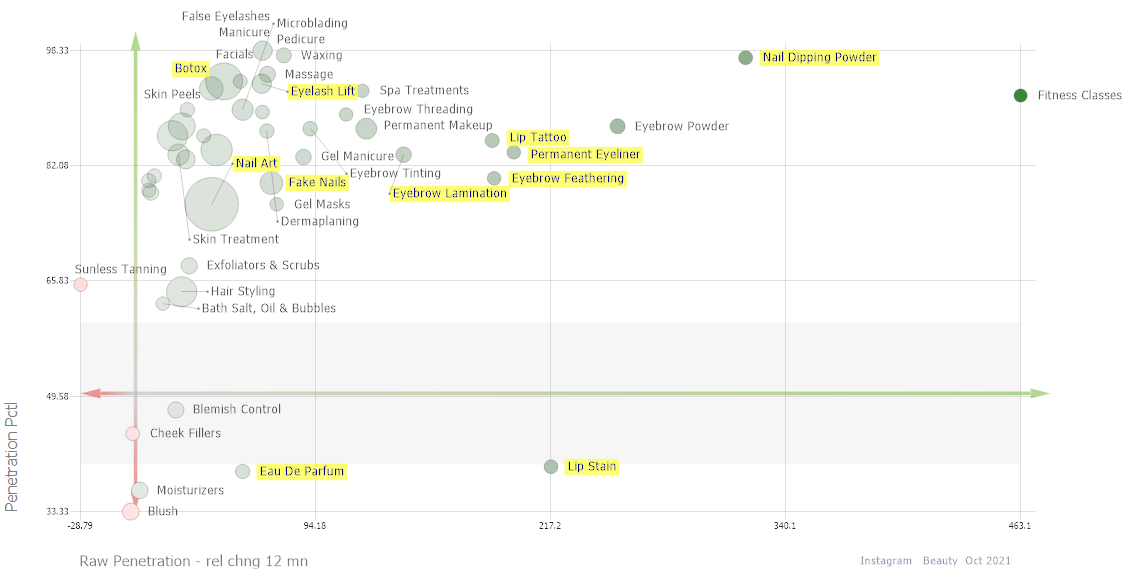

On-premise self care Beauty services, like waxing, massage, manicure, pedicure and lip injections are over-indexed with both mentions of shortage and Holiday or gift. Consumers may be concerned with Beauty appointment availability as they anticipate social events, or they may be gifting pampering experiences to friends and family. Ideas of relaxation and beautifying oneself and one's space are evident throughout these conversations and thus products that offer similar value will likely be popular with consumers this Holiday season.

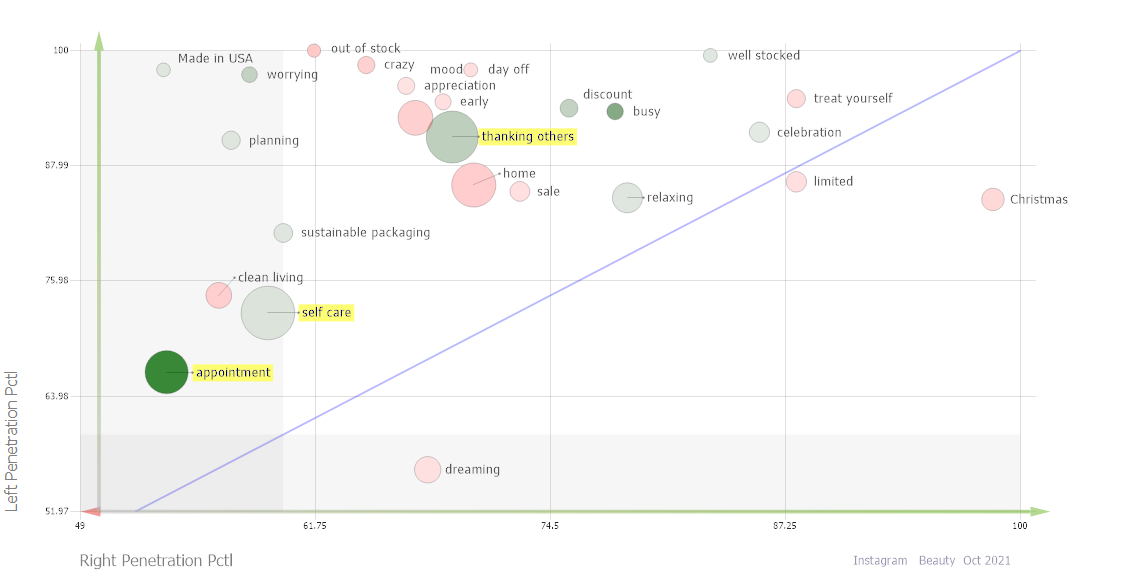

Interpreting the visuals: The images belows show topics that appear significantly and at the intersection of conversations that mention shortage and Holiday or gift. Generally, the topics that appear higher and to the left of the visual skew more towards shortage and topics that appear on the bottom right skew more towards Holiday or gift. The blue diagonal line is an indicator of similarity, so a topic closer to the line is equally important to both contexts.

| Product Categories in 'shortage' vs 'Holiday' or 'gift' Conversations |

|

| X-axis: | Right Penetration Pctl (1-100) | Is the topic over or under represented in 'Holiday or gift' conversations relative to Beauty - avg. over 3 months? | ||||

| Y-axis: | Left Penetration Pctl (1-100) | Is the topic over or under represented in 'shortage' conversations relative to Beauty - avg. over 3 months? | ||||

| Circle Color: | Right Raw Penetration chng | Has the topic grown or declined in 'Holiday or gift''s conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Circle Size: | Topic Prominence | Number of posts/conversations related to the topic in Beauty vertical |

When viewing the same intersection from a descriptive topic lens, concepts like self care, appointment, relaxing, celebration and thanking others appear significantly and are growing within the context of Holiday or gift conversations. Interestingly, most of the topics displayed, and all of the ones that are growing (green) in Holiday or gift conversations are more heavily skewed towards mentions of shortage, providing further evidence that the way consumers are thinking about Holiday gifting is influenced by product and service availablility.

| Descriptive Topics in 'shortage' vs 'Holiday' or 'gift' Conversations |

|

| X-axis: | Right Penetration Pctl (1-100) | Is the topic over or under represented in 'Holiday or gift' conversations relative to Beauty - avg. over 3 months? | ||||

| Y-axis: | Left Penetration Pctl (1-100) | Is the topic over or under represented in 'shortage' conversations relative to Beauty - avg. over 3 months? | ||||

| Circle Color: | Right Raw Penetration chng | Has the topic grown or declined in 'Holiday or gift''s conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Circle Size: | Topic Prominence | Number of posts/conversations related to the topic in Beauty vertical |

Reliance on Gift Cards

One way consumers may be combating shortages at retail is by relying on "I owe yous" in the form of gift cards. Mentions of gift cards are significantly associated with Beauty categories like permanent makeup for lip, lash and brow, nail products like fake nails, nail art, gel polish, and dipping powder, and skin treatments like body contouring, sunless tanning and injectibles. Furthermore, these categories are appearing more frequently in gift card conversations compared to last year.

| Product Performance in 'gift card' Conversations |

|

| X-axis: | Raw Penetration chng | Has the topic grown or declined in gift card conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in gift card conversations relative to Beauty - avg. over 3 months? | ||||

| Circle Color: | Raw Penetration chng | Has the topic grown or declined in gift card conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Circle Size: | Topic Prominence | Number of posts/conversations related to the topic in Beauty vertical |

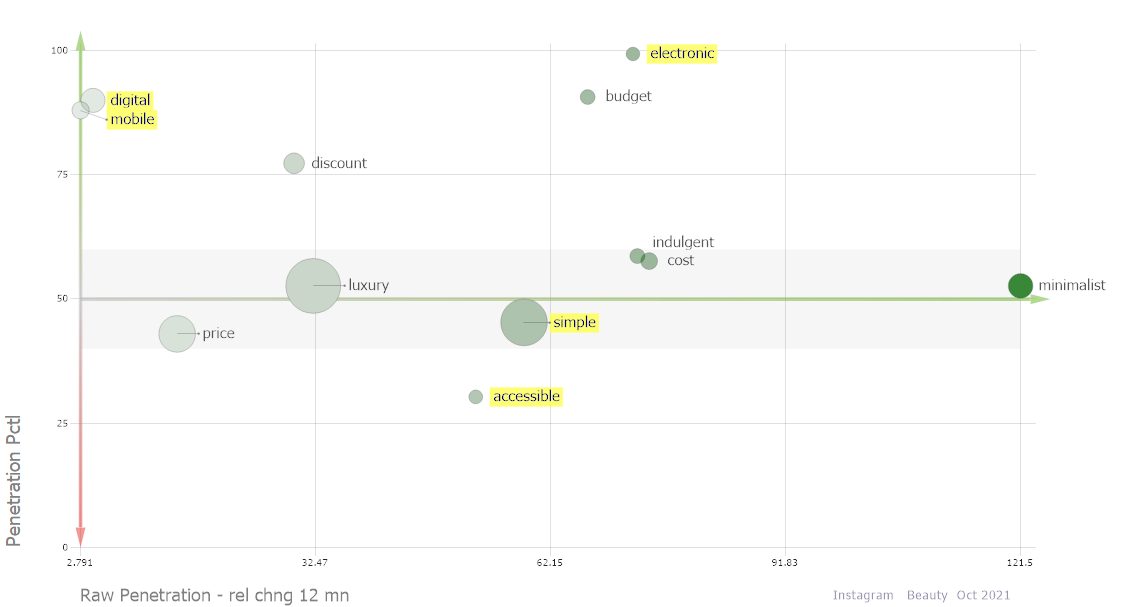

The ability to obtain, send and receive gift cards conveniently with new digital technologies, in combination with gift cards' ability to convey luxury and indulgent experiences, may make them particularly popular this year. Topics like electronic, digital, mobile, simple and accessible are increasingly visible in gift card conversations in Beauty. Other products and services that offer similar value may resonate well with consumers.

| Select Topics in 'gift card' Conversations |

|

| X-axis: | Raw Penetration chng | Has the topic grown or declined in gift card conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in gift card conversations relative to Beauty - avg. over 3 months? | ||||

| Circle Color: | Raw Penetration chng | Has the topic grown or declined in gift card conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Circle Size: | Topic Prominence | Number of posts/conversations related to the topic in Beauty vertical |

Stockpiling and Inelastic Demand

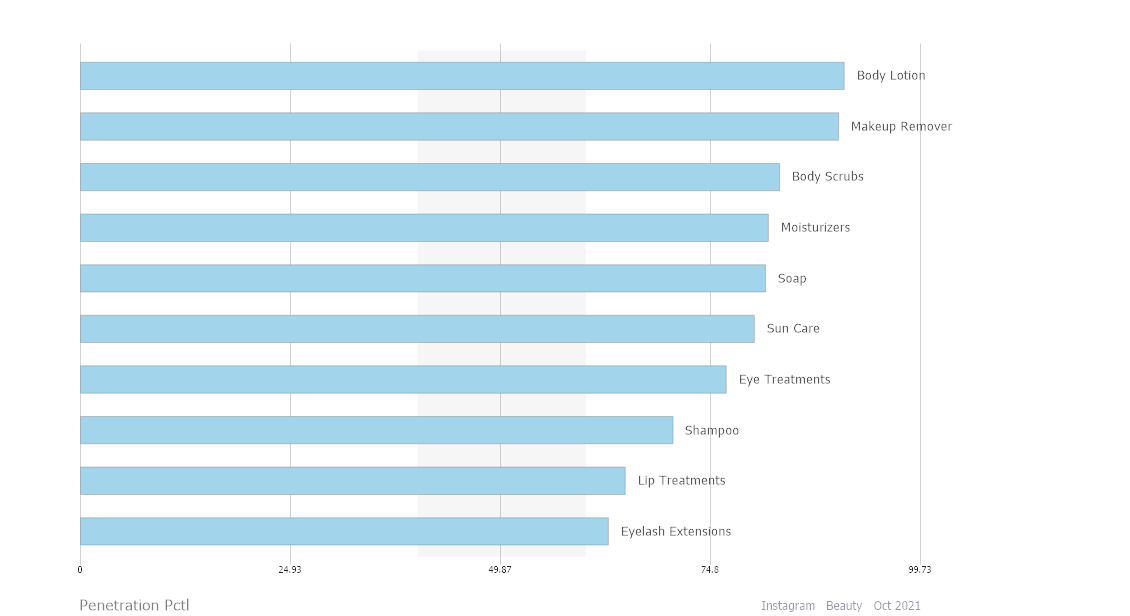

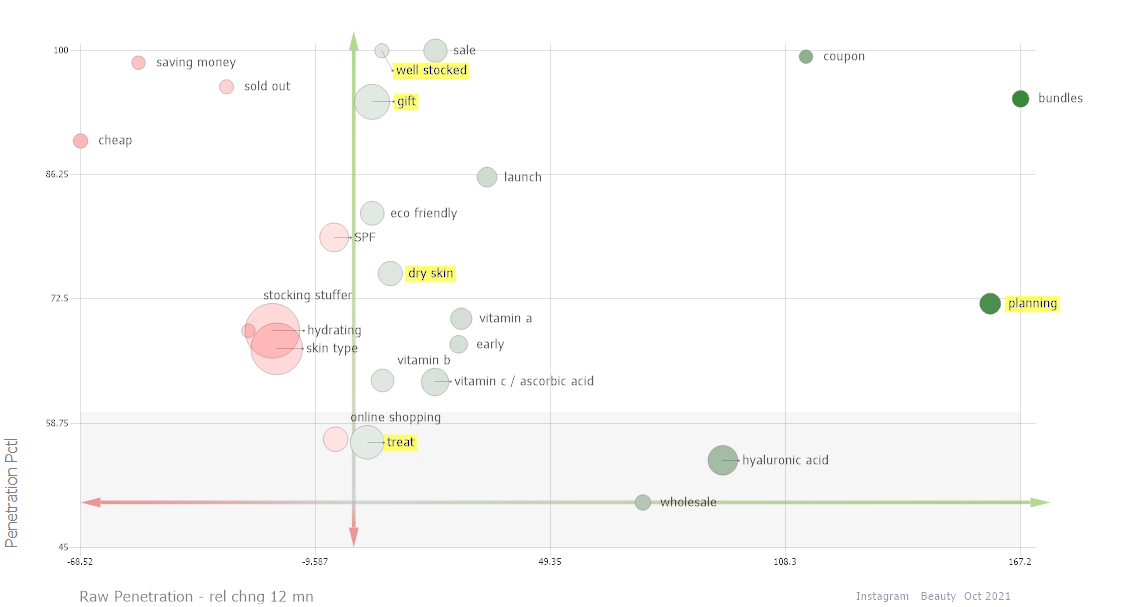

Anticipated shortages combined with Holiday promotions may create an environment that motivates hoarding or stockpiling behaviors. Skincare categories, like moisturizers and anti-aging treatments, are significantly associated with stockpiling mentions and may have inelastic demand in Beauty. Makeup remover and eyelash extensions are also over-indexed. These may be the categories that are top of mind when consumers feel the need to plan ahead their Beauty purchases.

| Select Categories in 'stockpiling' Conversations |

|

| X-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in stockpiling conversations relative to Beauty - avg. over 3 months? |

A significant and growing portion of stockpiling conversations appear to be associated with efficacious skincare ingredients, like vitamins A, B and C, and hyaluronic acid. Consumers may not be willing to go without the potent active ingredients that help them maintain beautiful and hydrated skin and could therefore intend to purchase more of these products than they immediately need. This, in turn, could result in higher short-term sales and longer periods between purchases.

Given that both gift and treat are significantly appearing and growing in stockpiling conversations, stockpiling behavior may not just be motivated by personal needs. Some consumers use gifting as an opportunity to splurge, so it is possible that consumers may be concerned with availability over price in the next few weeks. Within the last three months as mentions of gift and treat have increased in stockpiling conversations, mentions of saving money and cheap have declined.

| Descriptive Topics in 'stockpiling' Conversations |

|

| X-axis: | Raw Penetration chng | Has the topic grown or declined in stockpiling conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in stockpiling conversations relative to Beauty - avg. over 3 months? | ||||

| Circle Color: | Raw Penetration chng | Has the topic grown or declined in stockpiling conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Circle Size: | Topic Prominence | Number of posts/conversations related to the topic in Beauty vertical |

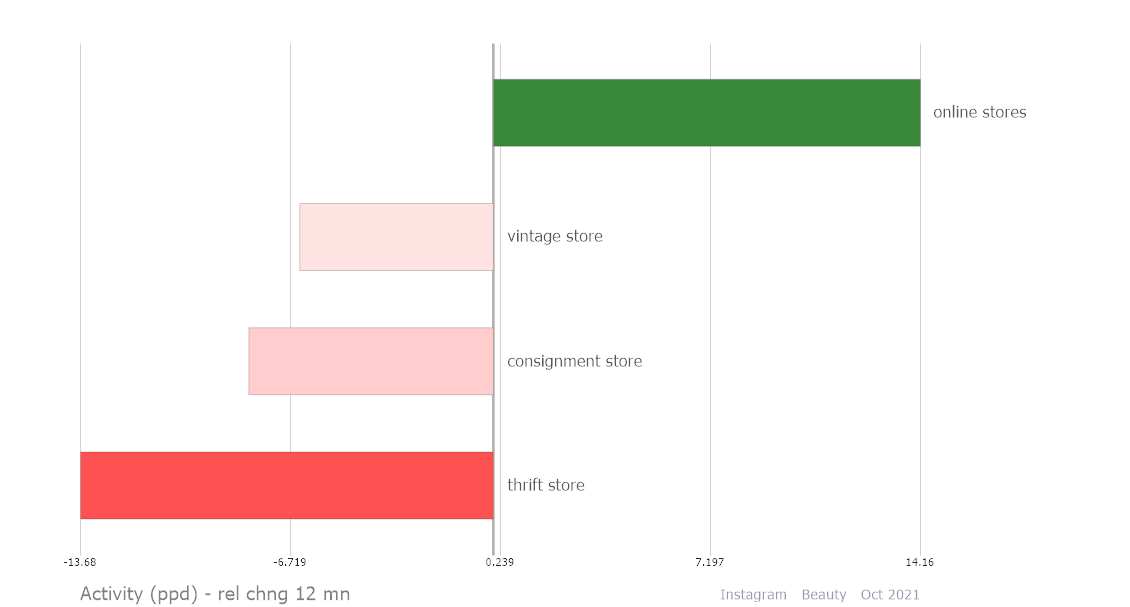

Shopping Alternative Channels

Unlike in Fashion, where low availability and high price appear to be motivators for consumers to seek offerings in secondary marketplaces, in Beauty these same issues may drive higher reliance on ecommerce. Mentions of online stores have increased while mentions of vintage, consignment and thrift store have declined in Beauty conversations over the same period.

| Select Locations' Performance in Beauty Conversations |

|

| X-axis: | Activity (ppd) chng | Is the topic growing or declining in Beauty over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Shading Color: | Activity (ppd) chng | Is the topic growing or declining in Beauty over the last 12 months (rel chng) - avg. over 3 months? |

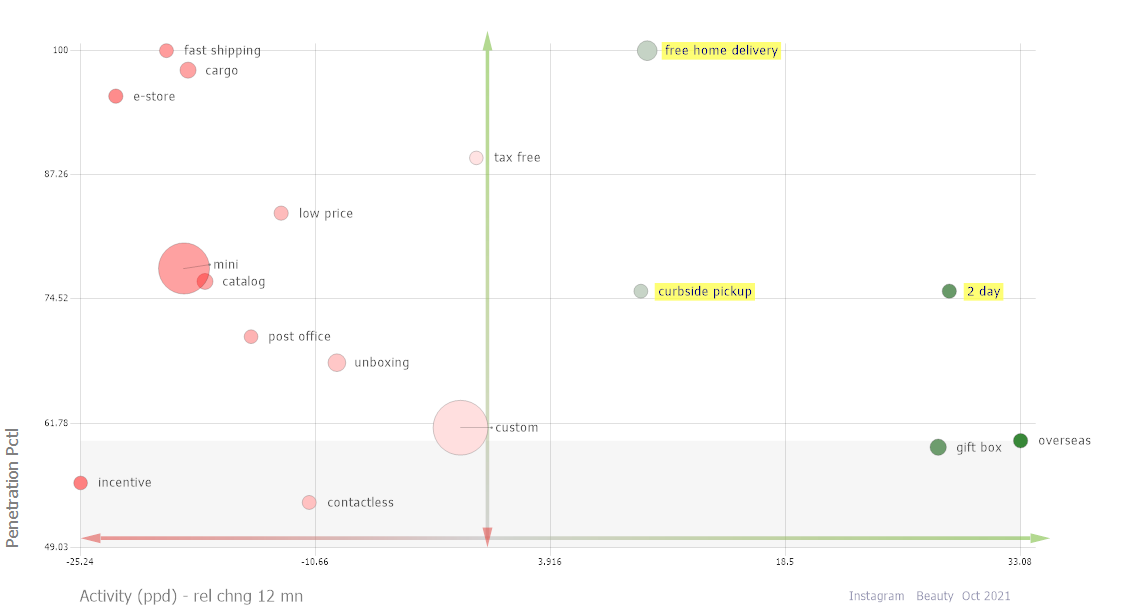

If consumers are turning to online stores more this Holiday season for their Beauty purchases, they may have higher expectations of shipping and delivery services compounding already existant issues in the supply chain. Particularly savvy shoppers may be on the lookout for shipping timelines and perks more so than usual this year. Mentions of free home delivery, curbside pickup and references to 2 day, as in 2 day shipping, are already increasing.

| Select Topics in 'Shipping' Conversations |

|

| X-axis: | Activity (ppd) chng | Is the topic growing or declining in Beauty over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in Shipping conversations relative to Beauty - avg. over 3 months? | ||||

| Circle Color: | Activity (ppd) chng | Is the topic growing or declining in Beauty over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Circle Size: | Topic Prominence | Number of posts/conversations related to the topic in Beauty vertical |

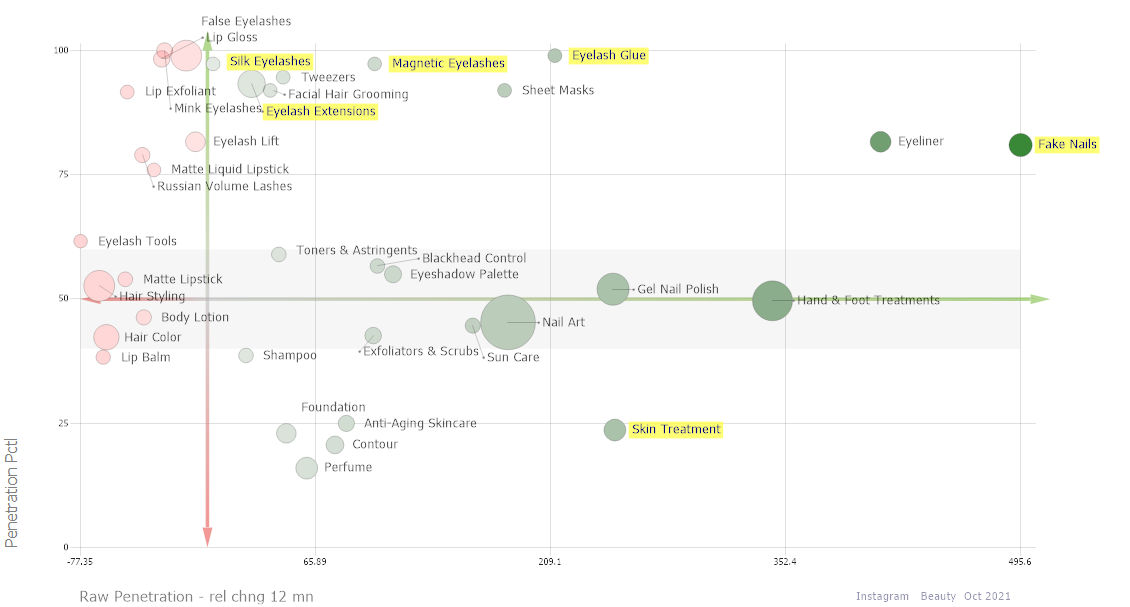

Product categories with reputations for efficient shipping may fare better for these reasons. Nail and eyelash products are significantly associated with and growing in conversations that mention fast shipping. Body skincare, hair care and personal scent categories appear less associated with fast shipping and could be more at risk if they are not readily available at retail.

| Product Categories in 'fast shipping' Conversations |

|

| X-axis: | Raw Penetration chng | Has the topic grown or declined in fast shipping conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Y-axis: | Penetration Pctl (1-100) | Is the topic over or under represented in fast shipping conversations relative to Beauty - avg. over 3 months? | ||||

| Circle Color: | Raw Penetration chng | Has the topic grown or declined in fast shipping conversations over the last 12 months (rel chng) - avg. over 3 months? | ||||

| Circle Size: | Topic Prominence | Number of posts/conversations related to the topic in Beauty vertical |

To win this Holiday season and beyond, companies will need to recognize consumers' concerns with goods availability and adapt to meet their resulting new demands. Convenience, reliability and permission to indulge may be major selling points for consumers who are wary of continued disruption to their lives and eager for celebration.

2015-2022 © by Social Standards, Inc.

last updated on Jan 06, 2022

Object IDs successfully added to clipboard