Gen Z Trends in Cosmetics

Provides perspective on the beauty preferences of Gen Z consumers and how those have changed over the past year.

Table of Contents:

Key Takeaways

Cosmetics and Gen Z

Products, Colors, and Priorities

Color Trends

Grunge

Methodology

Appendix

Key Metric Definitions

Key Takeaways

Gen Z consumers are over-indexed in conversations about a wide variety of cosmetics and formulations, with several related specifically to contouring or gel and liquid consistencies.

Many colors saw a huge increase in conversation volume at the beginning stages of the pandemic, such as sunset pink and sunset orange. Colors like these more than doubled in post volume from February to May of 2020; however, they have since decreased to below pre-pandemic levels. Colors that have seen significant growth in conversation volume since last year include lilac and mint green.

One of the most over-indexed qualities in Gen Z conversations was grunge. The 20th century aesthetic saw significant growth in conversation volume over the past year. Cosmetic brands that are both talked about by Gen Z consumers and involved in Grunge conversations include Jeffree Star Cosmetics, ColourPop and Revolution Beauty.

Cosmetics and Gen Z

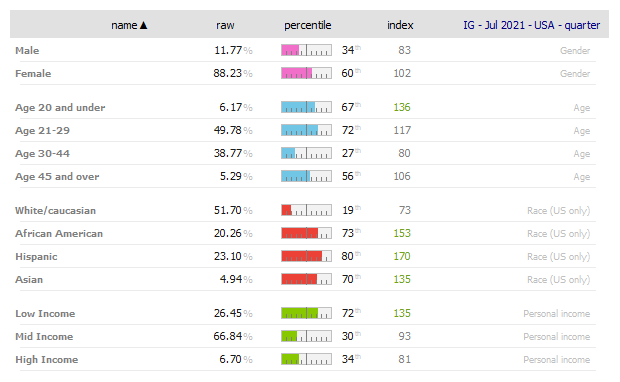

Across all Cosmetics conversations on Instagram, individuals aged 20 and under are the second most over-indexed age group, behind 21-29, by only 5 percentile points. Cosmetics skew more towards a multicultural, low income audience as a whole.

Interpreting the graph: About 6.17% of those who talk about Cosmetics on Instagram are identified as Age 20 and under for the three months ending in July 2021. This contribution rate ranks in the 67th percentile, meaning that only 33% of other Beauty conversations have higher levels of contribution from this cohort in comparison.

| Demographics of 'Cosmetics' |

|

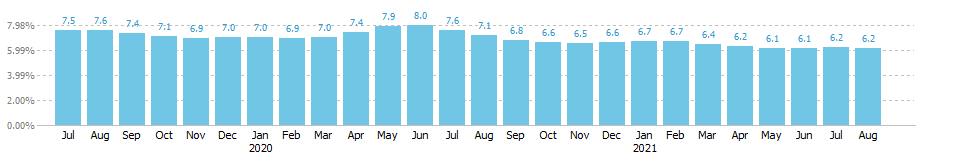

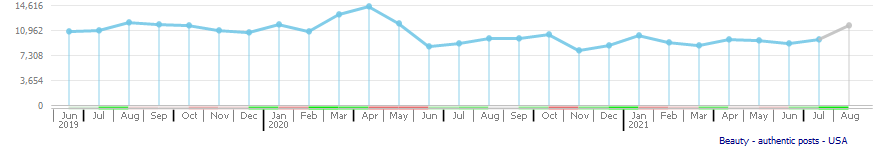

Overall, Gen Z consumers' contribution to Cosmetics conversations has remained relatively stable, with a slight decline in presence over the past two years, accounting for anywhere between 6%-8% of total Cosmetics conversation volume. This figure peaked in June of 2020, right in the middle of Pandemic restrictions.

Interpreting the graph: The image below shows the percentage of posts within Cosmetics on Instagram from consumers aged 20 and under in a given month.

| Cosmetics Conversation Volume from Age 20 and Under |

|

Products, Colors, and Priorities

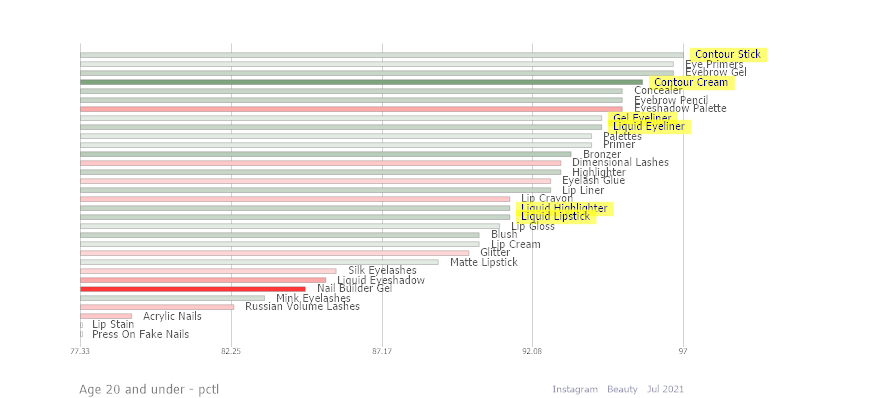

Gen Z consumers are over-indexed in a wide variety of conversations about different Cosmetics products and formulations. Many of these products are related to contouring, or have liquid and gel formulations.

Interpreting the graph: The image below showcases the trended degree of significance of consumers Age 20 and under in Cosmetics conversations relative to Beauty. On a scale from 0 to 100, falling between 40 - 60 indicates the normative range, or average. A percentile score greater than 60 is above average, and therefore over-indexing (or significant). Line color indicates the degree of growth or decline within Beauty for that topic overall independent of age.

| Gen Z Cosmetics Products |

|

| X-axis: | Age 20 and under - pctl | Is the topic over or under represented in conversations by Age 20 and under relative to Beauty? | ||||

| Shading Color: | Activity (ppd) chng | Is the topic growing or declining in Beauty over the last 12 months (rel chng) - avg. over 3 months? |

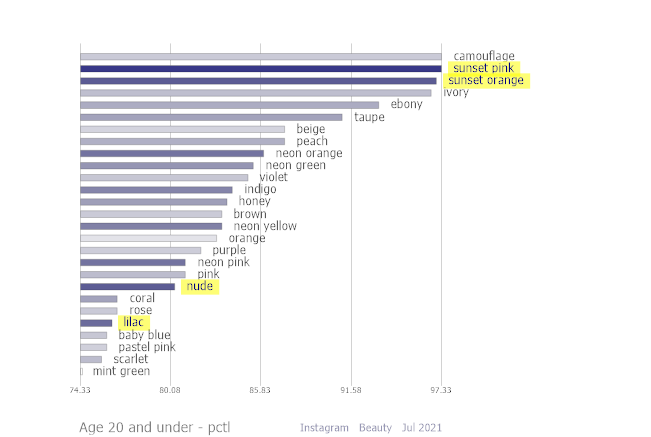

Gen Z consumers are over-indexed in particularly bright colors, including sunset pink, sunset orange, neon orange, and neon green. Others that stand out in which Gen Z consumers are over-indexed include nude and lilac, both of which have large overall conversation volume within Cosmetics.

Interpreting the graph: The image below showcases the trended degree of significance of consumers Age 20 and under in Cosmetics conversations relative to Beauty. On a scale from 0 to 100, falling between 40 - 60 indicates the normative range, or average. A percentile score greater than 60 is above average, and therefore over-indexing (or significant). Line color indicates the quantity of posts per day for that topic overall independent of age.

| Gen Z Cosmetics Colors |

|

| X-axis: | Age 20 and under - pctl | Is the topic over or under represented in conversations by Age 20 and under relative to Beauty? | ||||

| Shading Color: | Activity (ppd) | How many posts is the topic mentioned in per day - avg. over 3 months? |

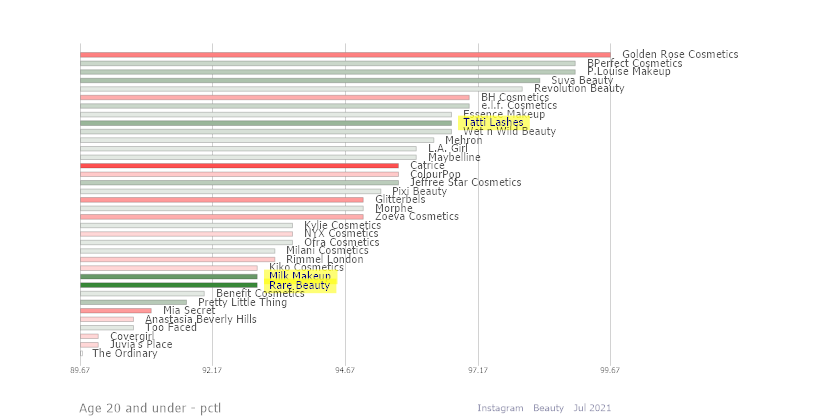

The Cosmetics brands that Gen Z consumers are over-indexed in most include Golden Rose Cosmetics, BPerfect Cosmetics, and P.Louise Makeup. The brands with the highest growth in conversation volume over the last year amongst which Gen Z consumers are over-indexed include Milk Makeup, Rare Beauty, and Tatti Lashes.

| Gen Z Cosmetics Brands |

|

| X-axis: | Age 20 and under - pctl | Is the topic over or under represented in conversations by Age 20 and under relative to Beauty? | ||||

| Shading Color: | Activity (ppd) chng | Is the topic growing or declining in Beauty over the last 12 months (rel chng) - avg. over 3 months? |

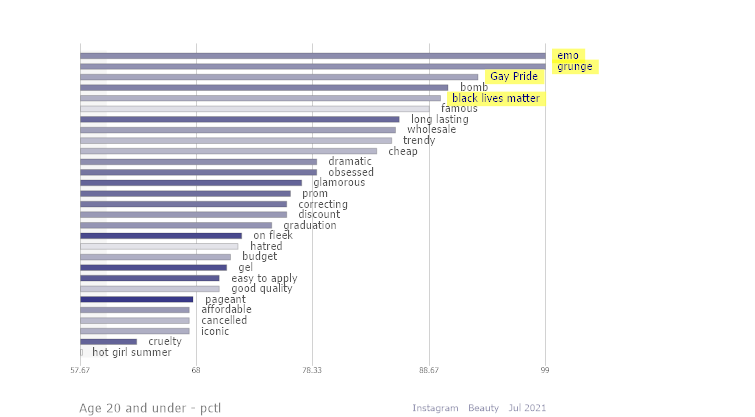

Gen Z consumers are heavily over-indexed in emo and grunge conversations, both of which are styles that were popularized in the '90s, indicating interest in nostalgic trends. Social issues also appear to be significant to Gen Z consumers, with Gay Pride and Black Lives Matter both significant topics of conversation.

| Gen Z Benefits, Concerns, Priorities and Descriptors |

|

| X-axis: | Age 20 and under - pctl | Is the topic over or under represented in conversations by Age 20 and under relative to Beauty? | ||||

| Shading Color: | Activity (ppd) | How many posts is the topic mentioned in per day - avg. over 3 months? |

Color Trends

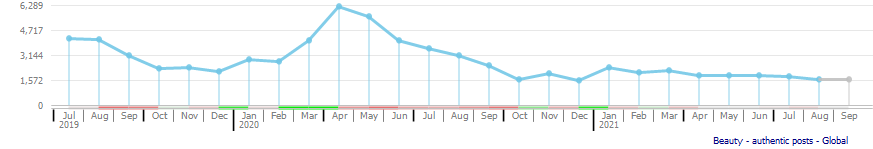

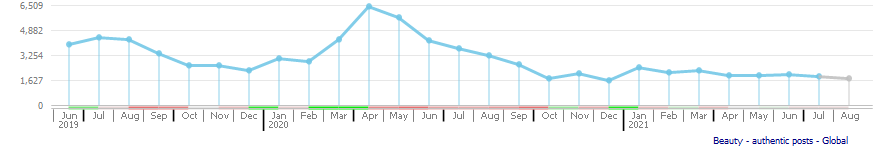

As previously mentioned, two of the colors that are most significantly talked about by Gen Z consumers include sunset pink and sunset orange. The conversation volume for both of these colors showcases a huge spike right at the beginning of the pandemic, peaking at over 6,000 posts in April of 2020. Conversation volume then dropped off in the Fall of 2020, returning to volumes lower than before the start of the pandemic. This may indicate that Gen Z consumers experimented with bright colors at the beginning of the pandemic, but pivoted to others soon after.

| Monthly Post Volume of 'sunset pink' |

|

| Monthly Post Volume of 'sunset orange' |

|

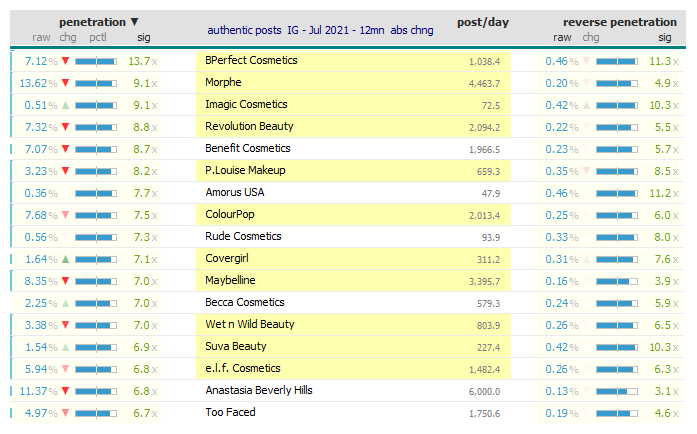

Many brands in which Gen Z consumers are over-indexed are also over-indexed in sunset orange conversations. These include Bperfect Cosmetics, Morphe, and P.Louise Makeup. This suggests that these brands may have been deliberately targeting Gen Z consumers by promoting such colors. Interestingly, many of the brands that are frequently mentioned alongside sunset orange have been declining in total post volume.

Read as: 7.12% of conversations about sunset orange mentioned BPerfect Cosmetics. This is roughly 13.7x the rate at which Bperfect Cosmetics was mentioned in the average Beauty conversation.

| Brand Relations for 'sunset orange' |

|

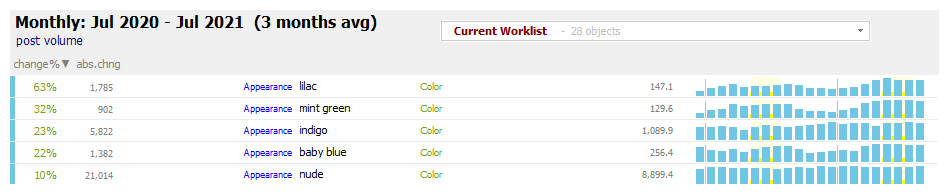

Of the colors that Gen Z consumers are over-indexed in, lilac, mint green, indigo, and baby blue have seen the largest growth in conversation volume over the past year. This may indicate that consumers are pivoting away from the bright colors they experimented with at the beginning of the pandemic, and embracing softer tones.

| Growing Colors |

|

Grunge

Gen Z consumers are in the 99th percentile of all grunge conversations , even though the style was popularized in the 1980's and 1990's. Grunge conversation volume briefly spiked right around the beginning of the pandemic, but returned to pre-pandemic levels in the Summer of 2020.

| Monthly Post Volume of 'grunge' |

|

Gen Z consumers also over-index in talking about a few brands that are over-indexed in grunge conversations, notably Jeffree Star Cosmetics at 2.2x the rate that this brand would be expected to show up in grunge conversations.

| Current Worklist Relations for 'grunge' |

|

Methodology

Social Standards is a comparative analytics platform transforming billions of social data points into benchmarked insights about every brand, product, feature, and trend consumers talk about. Innovative brands and investors use our data to make strategic decisions around product development, competitive differentiation, investments, and M&A opportunities so they can get ahead and stay ahead of the competition.

|

if you have additional questions, please email Andrea Spellman

Appendix

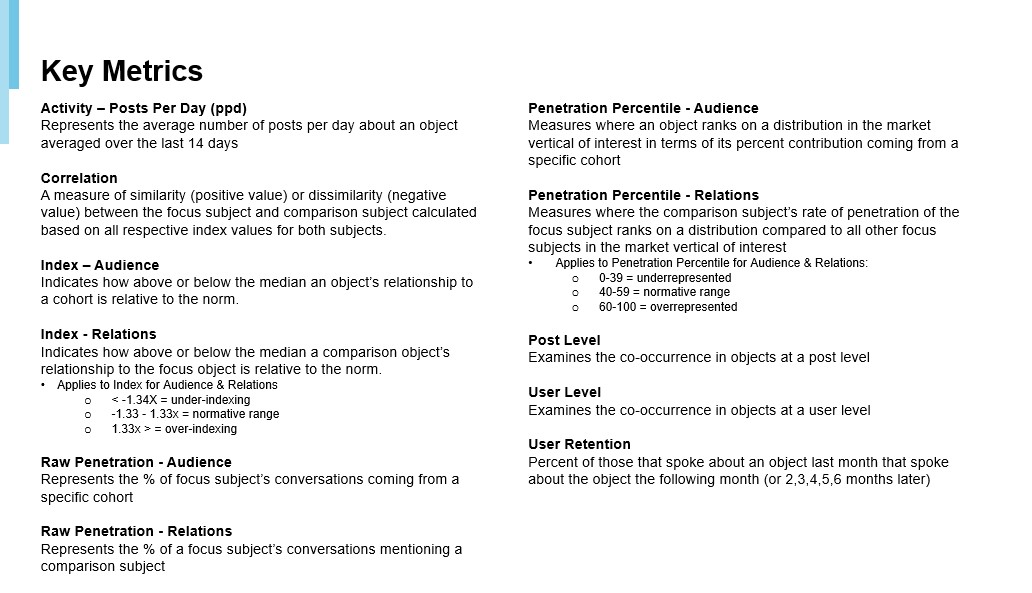

Key Metric Definitions

|

for additional metric definitions

2015-2022 © by Social Standards, Inc.

last updated on Oct 26, 2021

Object IDs successfully added to clipboard