Among social platforms, TikTok and Instagram are where most consumer trends take hold and propagate. As a result, these platforms also tend to give rise to short-term fads, as users seek to stay up-to-date with popular trends.

Fads tend to arrive swiftly and fade just as quickly. They often exhibit sudden growth within a small period of time, where larger industry shifts tend to exhibit gradual growth. Identifying when topics experience sudden, erratic growth would be a prime way of identifying a fad.

Furthermore, fads have difficulty in maintaining consumer interest, and become more noted for their popularity rather than for fulfilling specific consumer needs.

Fads tend to be most popular among younger consumers, usually under the age of 30. Categories that exhibit more cross-demographic appeal are less reliant on one demographic's needs, and therefore, have a better chance of sustained growth.

In today's fast paced social landscape, there are many trends that grow meteorically seemingly overnight. But just as quickly as trends manifest, they can lose steam, disappear, and become nothing more than a memory. It can be hard for businesses and decision makers to distinguish which trends are here to stay, and which are just fads.

In this piece, we aim to demonstrate the key factors that distinguish fads from large scale industry shifts, and how businesses can leverage these insights to inform strategy.

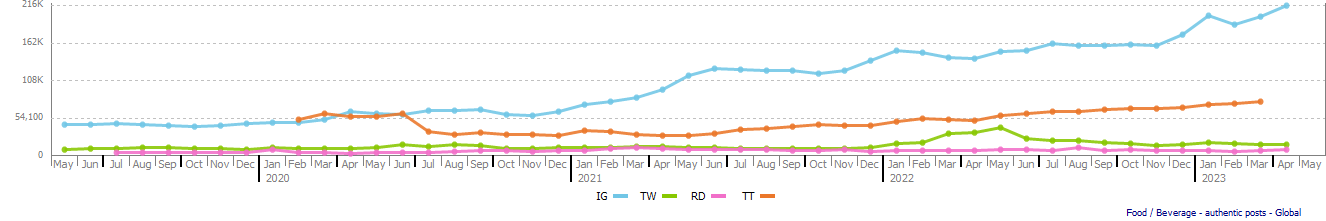

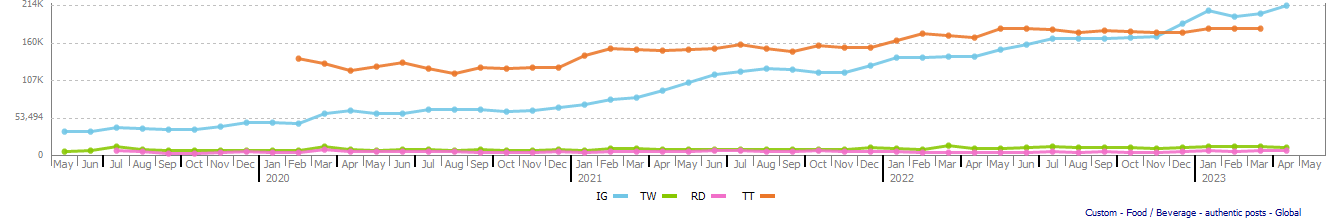

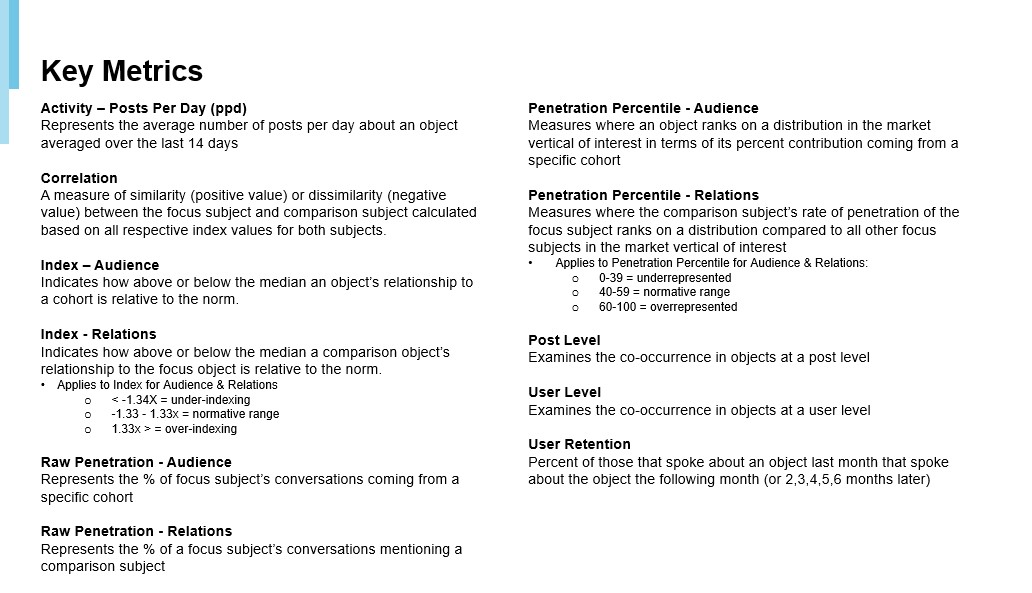

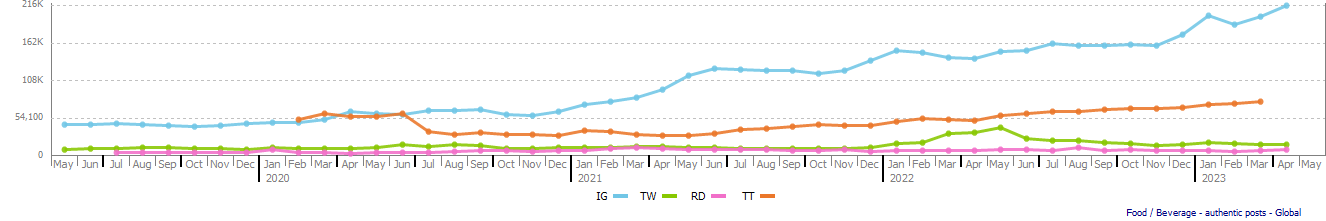

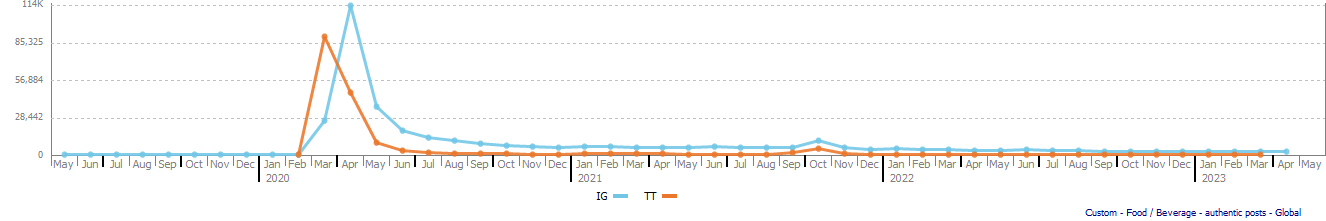

Across our available sources mentions of 'trending' and 'viral' are most frequent and growing on Instagram (blue) and TikTok (orange). Comparatively, Twitter (green) only exhibits periodic bumps, while Reddit (pink) is fairly stagnant in terms of mentions.

| Monthly Post Volume of 'trending' |

|

| Monthly Post Volume of 'viral' |

|

With Instagram and TikTok driving the brunt of 'viral' and 'trending' mentions online, the focus of this report will be on TikTok and Instagram data. Each visual will have the analyzed data source labelled.

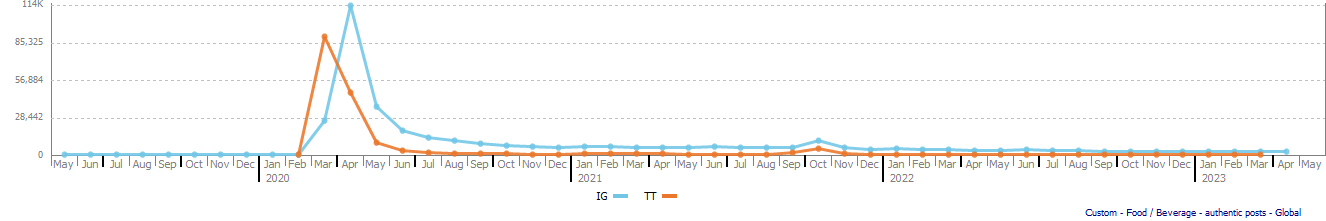

Fads frequently exhibit meteoric growth over a small period of time, followed by equally rapid decline once user interest has waned.

Dalgona coffee, the Korean whipped coffee, blew up in popularity in the early months of 2020. A combination of factors, however, led to the category waning just as quickly as it grew, and it has remained stagnant and relatively low in activity since.

| Monthly Post Volume of 'Dalgona / whipped coffee' |

|

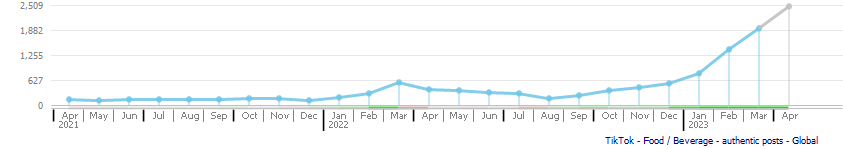

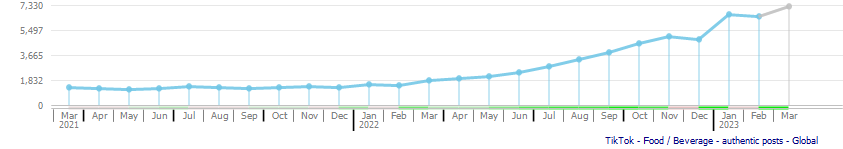

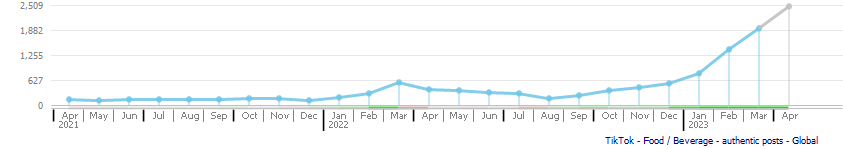

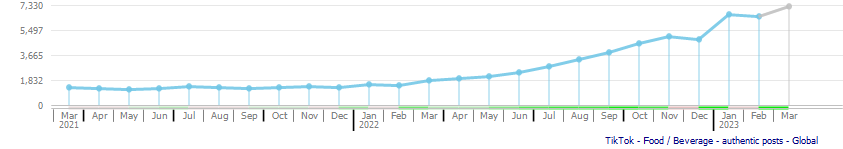

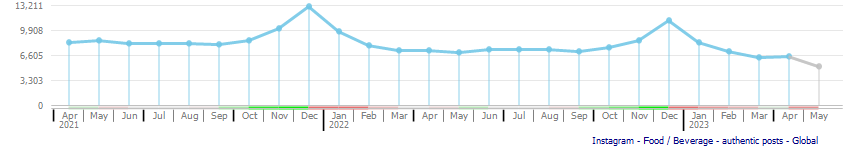

We can see some early indicators of a potential fad in 'candied grapes'. Category activity grew about 208% in Q1 of 2023, and 121% in Q4 of 2022.

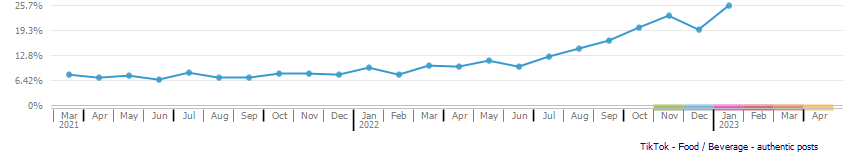

In comparison, a category like Olive Oil has experienced more consistent growth over a longer period of time-- over 2022, growth on TikTok averaged around 40-55% QoQ.

| Monthly Post Volume of 'candied grapes' -TT |

|

| Monthly Post Volume of 'Olive Oil' -TT |

|

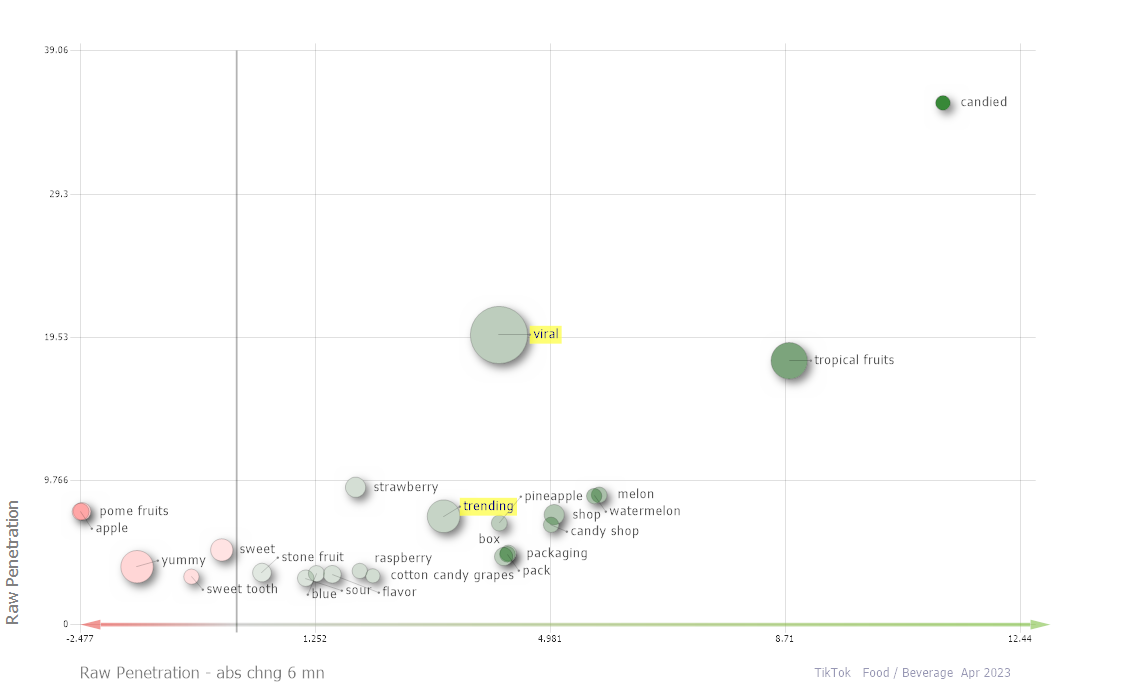

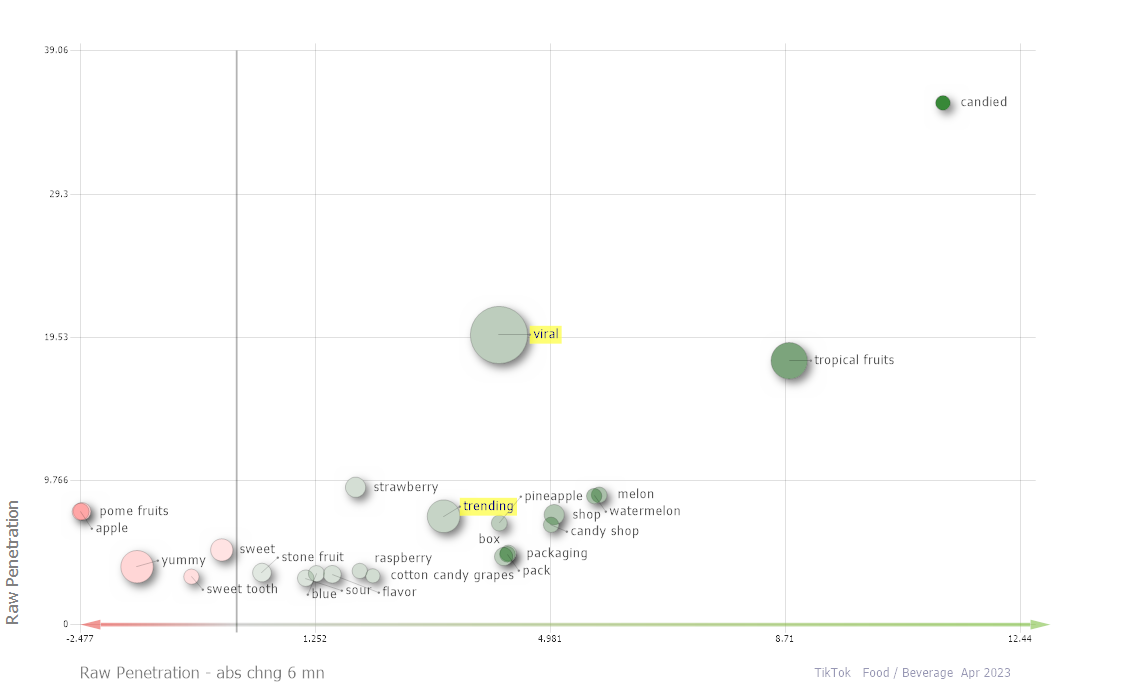

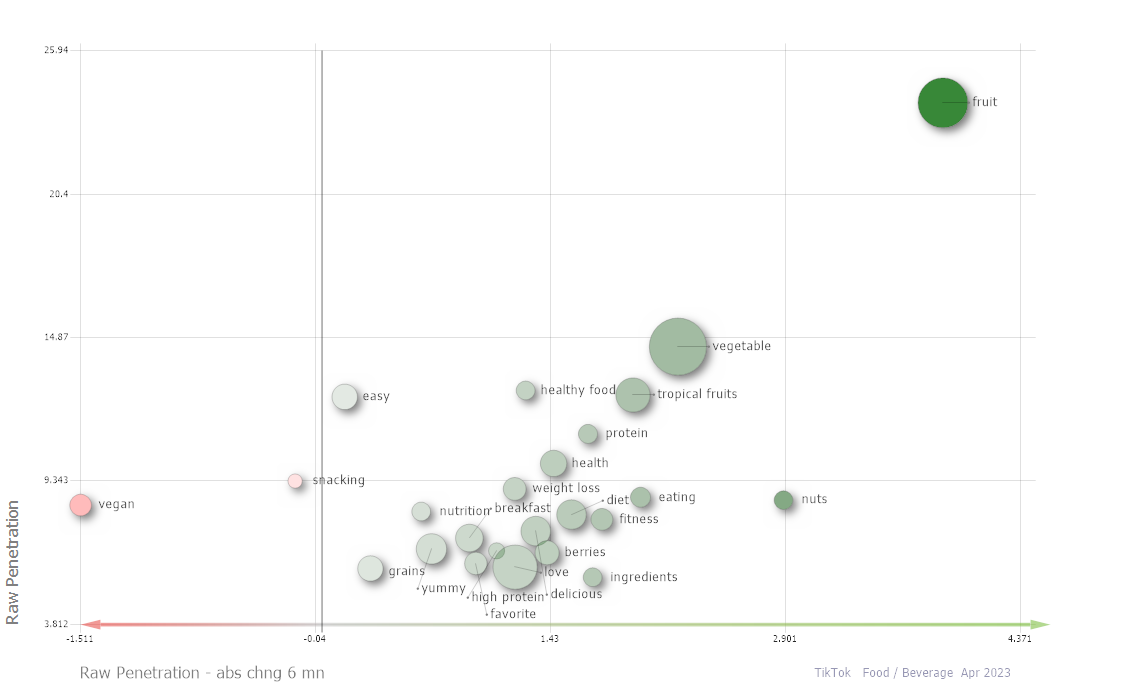

Terms related to popularity such as 'trending' and 'viral' are growing faster in 'candied grapes' posts than topics more closely tied to the category such as related flavors and descriptors. The fact that 'candied grapes' are becoming increasingly associated with virality, rather than specific consumer needs, might lead to less sustained growth over time.

| Descriptors Share vs. 6 Month Growth/Decline in 'candied grapes' (posts) [TT] |

|

| | X-axis: | | Raw Penetration chng | | Has the topic grown or declined in candied grapes conversations over the last 6 months (abs chng) - avg. over 3 months? | |

| | Y-axis: | | Raw Penetration % | | How frequently was the topic mentioned in candied grapes conversations - avg. over 3 months? | |

| | Circle Color: | | Raw Penetration chng | | Has the topic grown or declined in candied grapes conversations over the last 6 months (abs chng) - avg. over 3 months? | |

| | Circle Size: | | Topic Prominence | | Number of posts/conversations related to the topic in Food / Beverage vertical | |

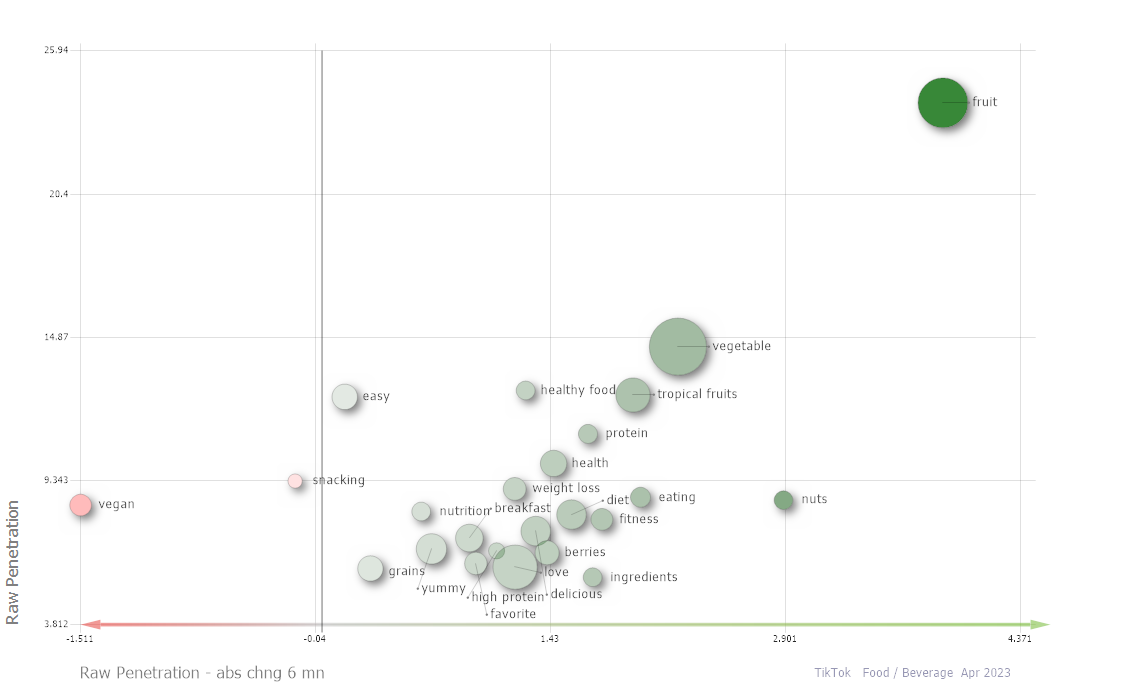

On the other hand, a category like 'healthy snacks' is generally discussed alongside category-specific motivators, like 'nutrition' or 'breakfast'. This will likely lead to longevity in user interest.

| Descriptors Share vs. 6 Month Growth/Decline in 'healthy snacks' (posts) [TT] |

|

| | X-axis: | | Raw Penetration chng | | Has the topic grown or declined in healthy snacks conversations over the last 6 months (abs chng) - avg. over 3 months? | |

| | Y-axis: | | Raw Penetration % | | How frequently was the topic mentioned in healthy snacks conversations - avg. over 3 months? | |

| | Circle Color: | | Raw Penetration chng | | Has the topic grown or declined in healthy snacks conversations over the last 6 months (abs chng) - avg. over 3 months? | |

| | Circle Size: | | Topic Prominence | | Number of posts/conversations related to the topic in Food / Beverage vertical | |

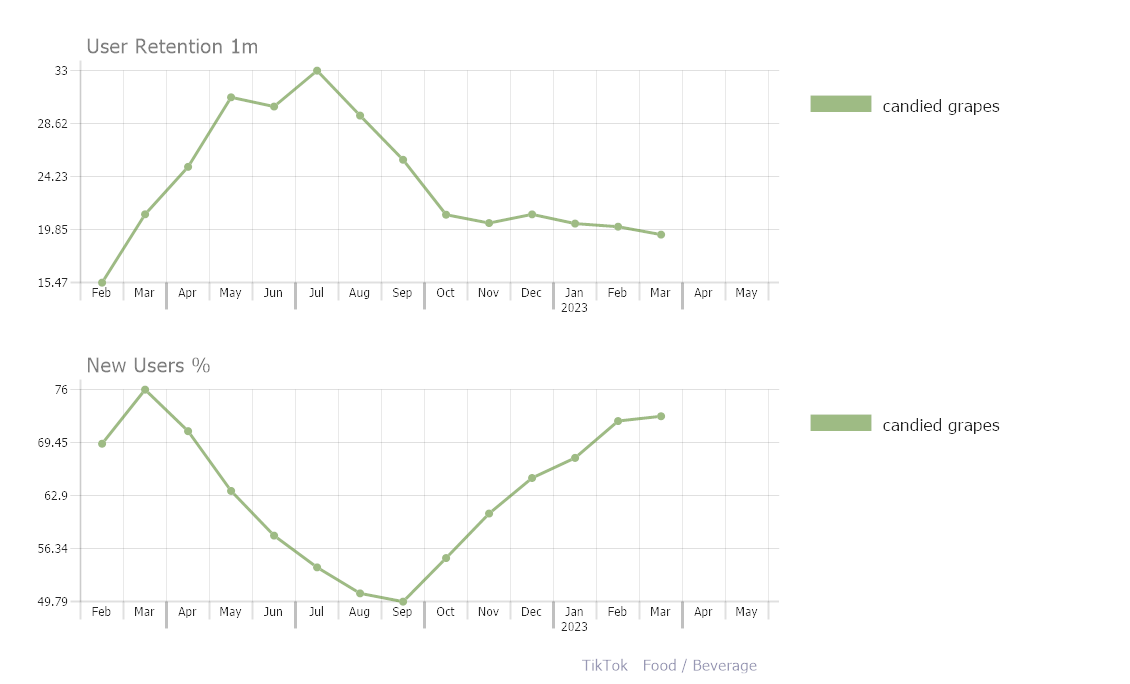

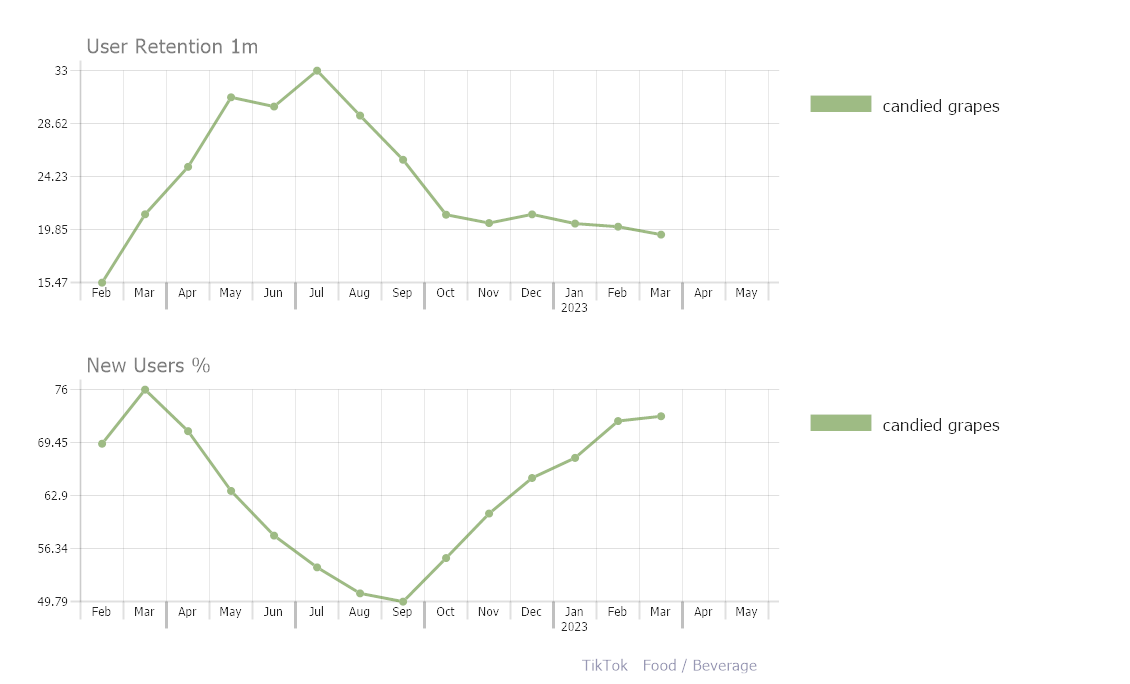

The following visual shows what share of users discussing 'candied grapes' in one month continue to discuss a month later, as well as what share of users are new. 'candied grapes' clearly exhibits an influx of new users over the last six months. However, because of the category's popularity, and likely over-saturation, it is struggling to hold consistent user interest over a long period of time.

| New User Loyalty- 'candied grapes' [TT] |

|

| | | | User Retention 1m | | What % of users who talked about the topic in a given month are still talking about it 1 month later - avg. over 3 months? | |

| | | | New Users % | | What % of users talking about the topic are new (have not talked about it in the last 6 months) - avg. over 3 months? | |

Read as: In January 2023, about 68% of users discussing 'candied grapes' had not talked about it in the previous six months. About 20% of users who discussed it that month continued to discuss it in February. This retention rate is down from July 2022, however, when about 33% of users continued to discuss the category in August.

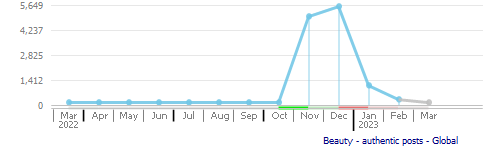

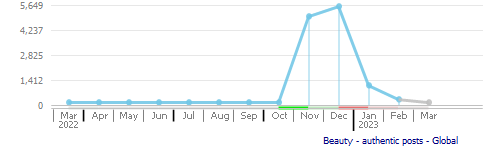

Seasonal topics exhibit characteristics of fads in the short-term. However, cyclical year-to-year momentum, as seen with 'brie cheese' indicates regular relevance. Only time will tell if the recent Beauty trend of the 'cold girl makeup look', which saw an increase in popularity last winter, will bubble up again in Q4 of 2023.

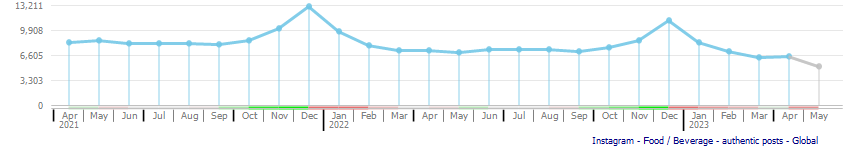

| Monthly Post Volume of 'brie cheese' - IG |

|

| Monthly Post Volume of "I'm cold / cold girl makeup look" - TT |

|

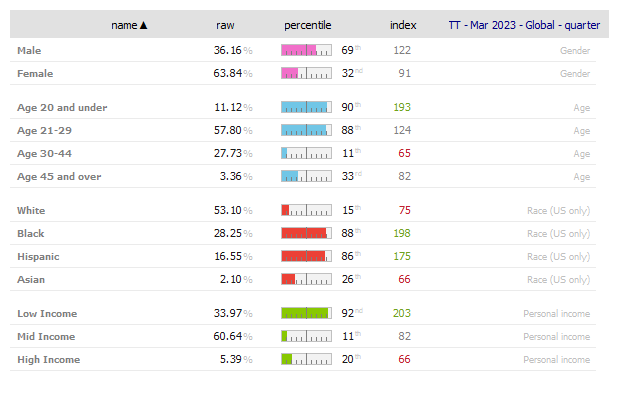

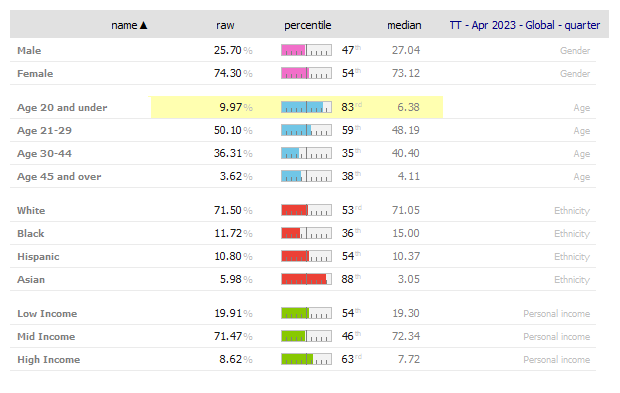

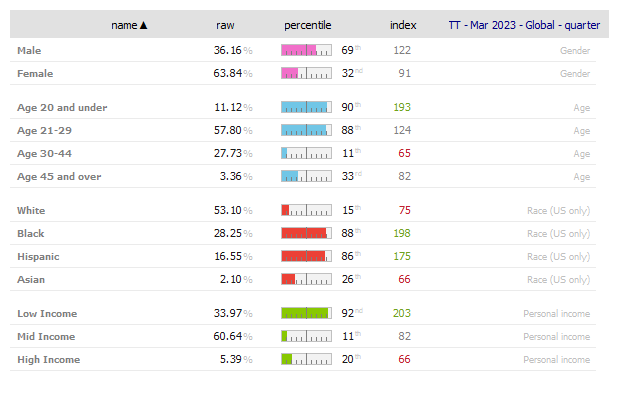

Expectedly, topics like 'trending' skew significantly younger. On TikTok, about 58% of all mentions of 'trending' come from those Aged 21-29. Additionally, this contribution rate ranks at the 88th percentile, indicating only 12% of similar terms have higher rates of contribution from this cohort. Knowing that younger users have a tendency to grab on to rapidly trending topics, we can begin to identify what topics are likelier to fizzle out long-term.

| Demographics for 'trending' [TT] |

|

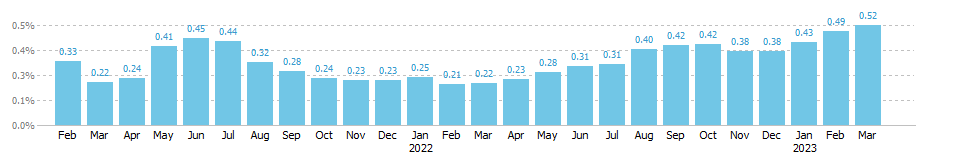

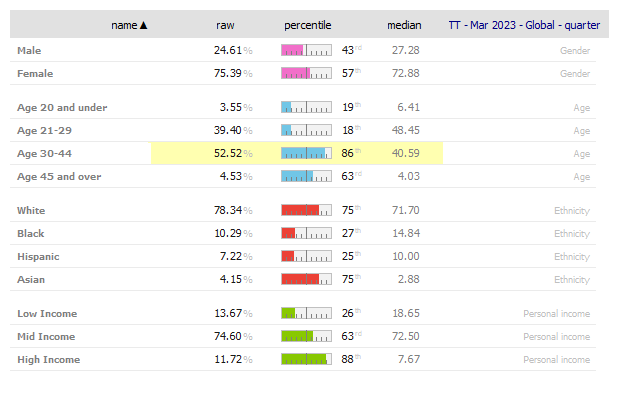

When topics are trending, a majority of the momentum appears to come from younger users. Though Preserved Vegetables has a presence with older users, the recent uptick of 'trending' in these posts is likely propelled by its younger audience.

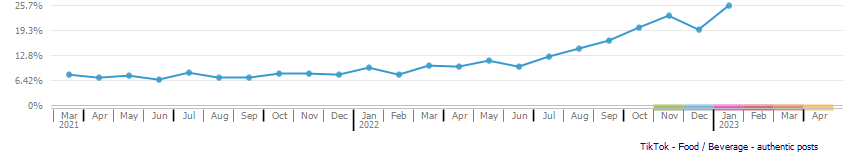

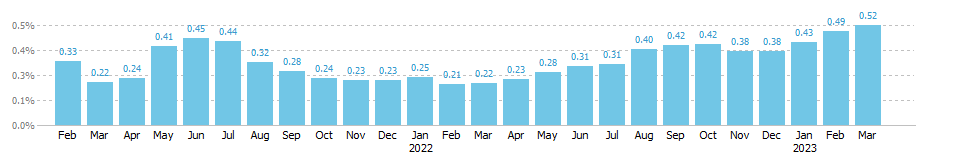

| Share of 'trending' in 'Preserved Vegetables' (%) - Posts - TikTok |

|

| Demographics for 'Preserved Vegetables' -TT |

|

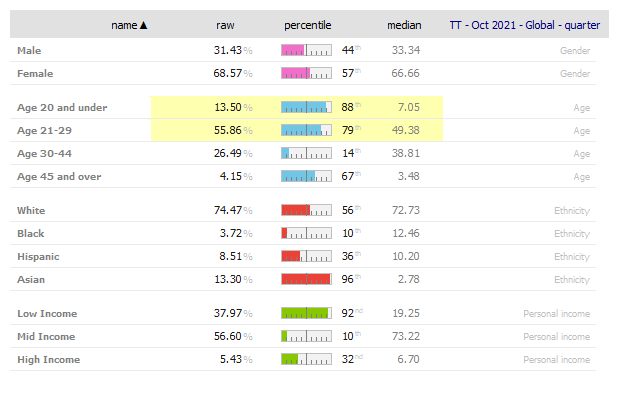

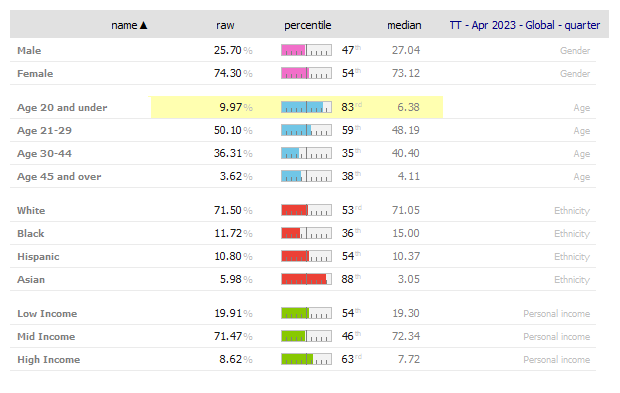

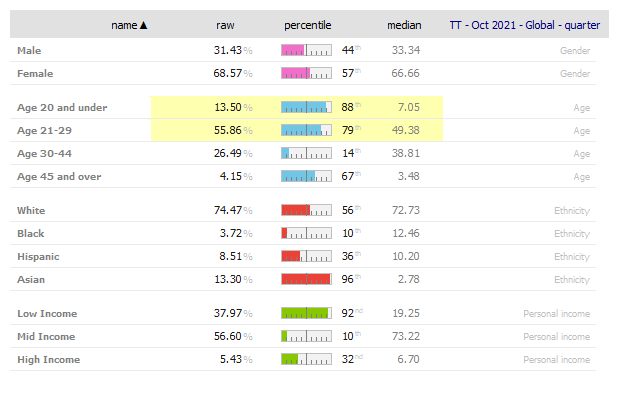

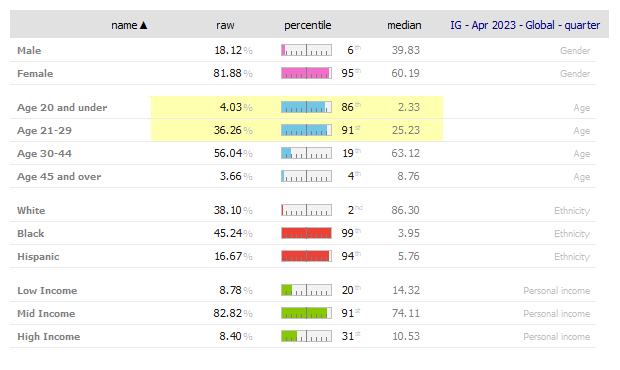

We can see this with Dalgona Coffee, which skews significantly towards younger users. Almost 70% of all mentions of the topic came from users Aged 29 and under. Notably, this same skew is true for 'candied grapes'.

| Demographics for 'Dalgona / whipped coffee' - TT |

|

| Demographics for 'candied grapes' - IG |

|

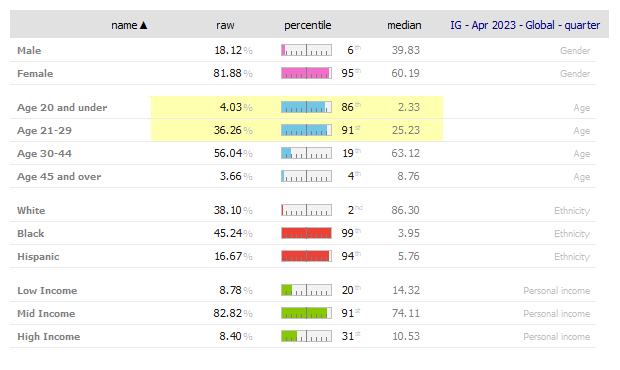

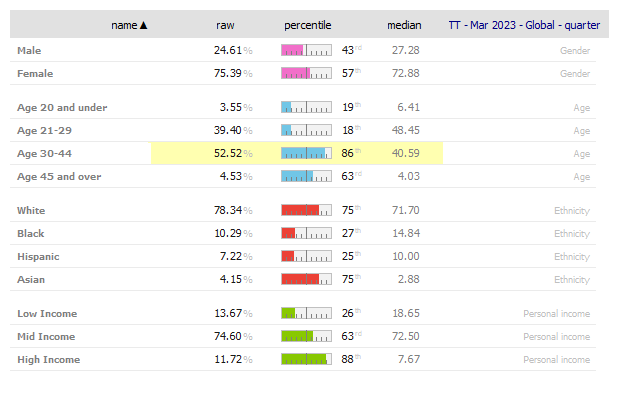

Olive Oil, however, which exhibits a majority of traffic from users Aged 30-44, exhibits much more consistent, and growing, user retention month-to-month.

| Demographics for 'Olive Oil' [TT] |

|

| 1-month User Retention for 'Olive Oil' [TT] |

|

Distinguishing fads from larger industry shifts is a tricky game, and can hinge on vertical or product-specific attributes. However, the rules of thumb to follow when trying to avoid jumping on the fad-wagon are:

1. Consistency: Consistent growth over a longer period of time generally leads to longevity and sustained user interest.

2. Diversity: Both in demographics and in associated topics, trends that are propelled entirely by one age group, or are most associated with 'virality', tend to fizzle out quickly. Topics poised for longevity tend to address key consumer demands, and exhibit much more cross-demographic diversity.

3. Retention: Any topic that starts to trend is invariably going to attract a new horde of users. But are these users maintaining interest? High user retention-- if users are consistently discussing a topic from month-to-month-- is a good sign of a topic that's here to stay.

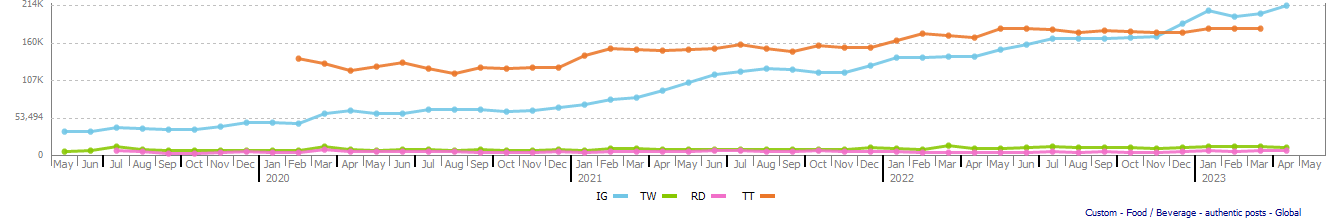

for additional metric definitions